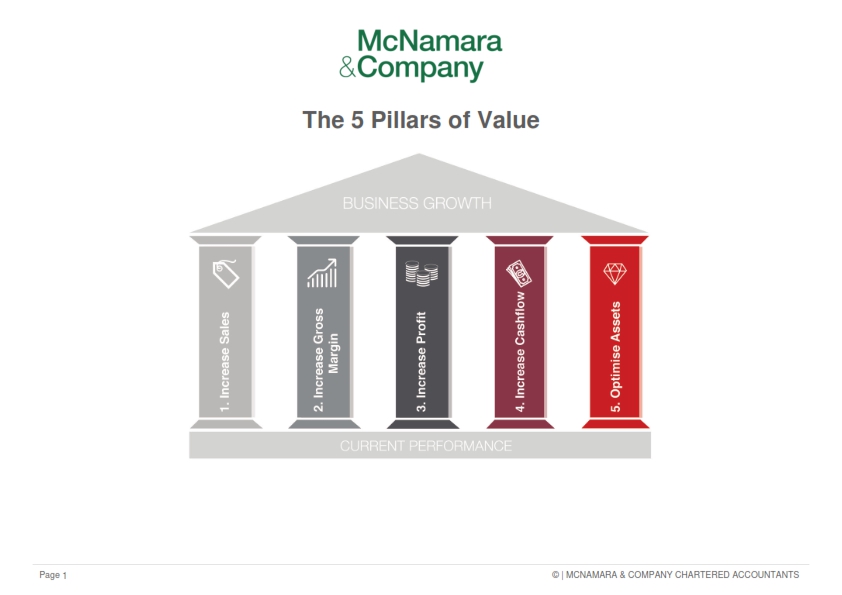

Generate business growth and increase your business value with these five strategic pillars

Whether you’ve just started your business or you’re a business veteran, you may have one strategic business goal in common: Business growth.

Sadly, this doesn’t happen overnight and in amongst the busy day-to-day hum of business it might seem like a lot of work. However, there are five strategic pillars you can leverage within your business today that can help you accelerate growth and drive business improvement.

How to increase your business growth and value

As a business advisor, one of the biggest questions we get asked is: How do I grow my business and improve my business health?

While each and every business is different, we recommend focusing on five pillars of value.

Sales

Gross Margin

Profit

Cash flow

Assets

Each are interlinked and contribute to business growth and improvement. As such, changing one could have an adverse effect on the other.

For example, dropping your prices may attract new customers and increase revenue, but it could reduce your profit margin in turn. You might also consider increasing your prices to increase profit. However, if your customers don’t see value in your more-expensive product or service, this could then impact your overall sales.

By building a business strategy that considers all five pillars, you can drive real business improvement, improve your overall business health, and create a strong foundation for growth.

Increasing your sales

It’s no surprise that sales are an essential metric for business improvement and growth. After all, sales (or revenue) drives profitability. It’s also a key measure we look at as business advisors to assess your business health.

When creating a strategy to increase sales, you need to determine if you’d like to drive this by:

Increasing the number of customers

Increasing the size of transactions per customer (such as your price per product or service)

Increasing the number of transactions per customer

Increase retention rate

Increasing leads

Increasing conversions

Improving or automating processes as well as investing in additional resources, tools and trainging can also improve and impact sales outputs.

Increasing your gross margin

Your gross margin is your profit after your cost of goods (or COGS) are subtracted, such as materials, labor or distribution costs. Gross margin is an important metric to measure and monitor, and it’s one of the key areas we review during business advisory check-ins to assess profitability. Generally, the higher your gross margin, the better – and more profitable – your business is.

When creating a business strategy to lift your gross margin, it’s important to understand what profits you're making per customer as well as what overheads and costs are associated. It’s also important to understand what costs are fixed vs variable.

Here, reporting and insights are key. Working with your accountant or business advisor, you can uncover opportunities to reduce operating costs and costs per service or product.

Increase profit

Your profitability underpins your business health and your ability to grow. Afterall, without it, your business doesn’t exist.

There are many factors that can influence your profits, including pricing, fixed costs and even your team’s productivity. To increase profit, it’s important to look at what you’re making for each sale (or customer) after allocating fixed overheads.

As you can imagine, to get true insights you need the full picture of costs. To get this, your records – receipts, accounts and overall accounting data – must be up to date. Reports focused on revenue, gross profit and fixed overheads will also provide insight into profitability.

It’s here that real-time data can add a lot of power, enabling you to view, access and analyse data as soon as it flows into your business. In turn, enhancing your ability to make faster business decisions, identify trends, and drive efficiencies.

If you don’t have reporting in place or your data up to date, this can be a daunting task. Meeting with an accountant or business advisor such as McNamara and Company can help you create processes, reports and systems to keep you on track. They can also help you set up online systems to get access to real time data for your business.

Increase cash flow

Cash flow is the lifeblood of your business, and if you can’t circulate it your business will die. Even if your overall business is profitable, you may still go out of business if you don’t have enough cash flowing in to cover everything.

Cash flow is the money flowing in and out of your business, and ideally you want a positive cash flow (with more money coming in than going out). Monitoring your cash flow is essential for business growth, allowing you to assess if you have enough funds coming in to cover expenses, bills and upcoming financial commitments. Monitoring your cash conversion cycle as well will uncover what’s locking up your cash as well as debtor and credit days.

To help increase your cash flow, consider:

Are your customers paying on time?

Could you offer a discount for those paying early?

Can you negotiate different payment terms with suppliers (without impacting price of purchase)?

Would it be better to lease instead of buying equipment?

Reviewing your staffing, could you have flexible staffing arrangements?

Could you better manage stock and put processes in place to reduce over-ordering?

If you’re not sure where to look - or even what’s eating away at your cash flow - booking time with our accounting or business advisory team could be a great first step and give you the insight you need to take action.

Optimise assets

If you haven’t optimised your assets before, this could seem like an odd phrase. Asset optimisation has many benefits, including:

Better business performance

Increasing asset availability

Decreasing maintenance costs

Decreasing downtime and operational impacts

For small to medium organisations, optimising your assets is important for business growth as you don’t have many resources or have limited budget to invest in them. Optimising your assets increases your return on investment and allows you to maximise value, decreasing your cost of ownership in the process. It also ensures your assets are the most efficient and effective they can be, reducing downtime.

The first step to optimisation is to get a full picture of the business assets. To do so, it’s important to have an up-to-date asset register and conduct regular asset audits. Here, reporting and an analytics tool of some kind is essential. Without it, you could lose track of assets or cause downtime by not being on-top of required maintenance or compliance standards.

To optimise your assets, we recommend including this in your quarterly or annual reviews or check-ins with your business advisor or accountant.

Please call 03 9428 1062 or email admin@mcnamaraandco.au

How healthy is your business?

Use our business health check tool to assess the health of your business or request a health check discussion with our expert team.