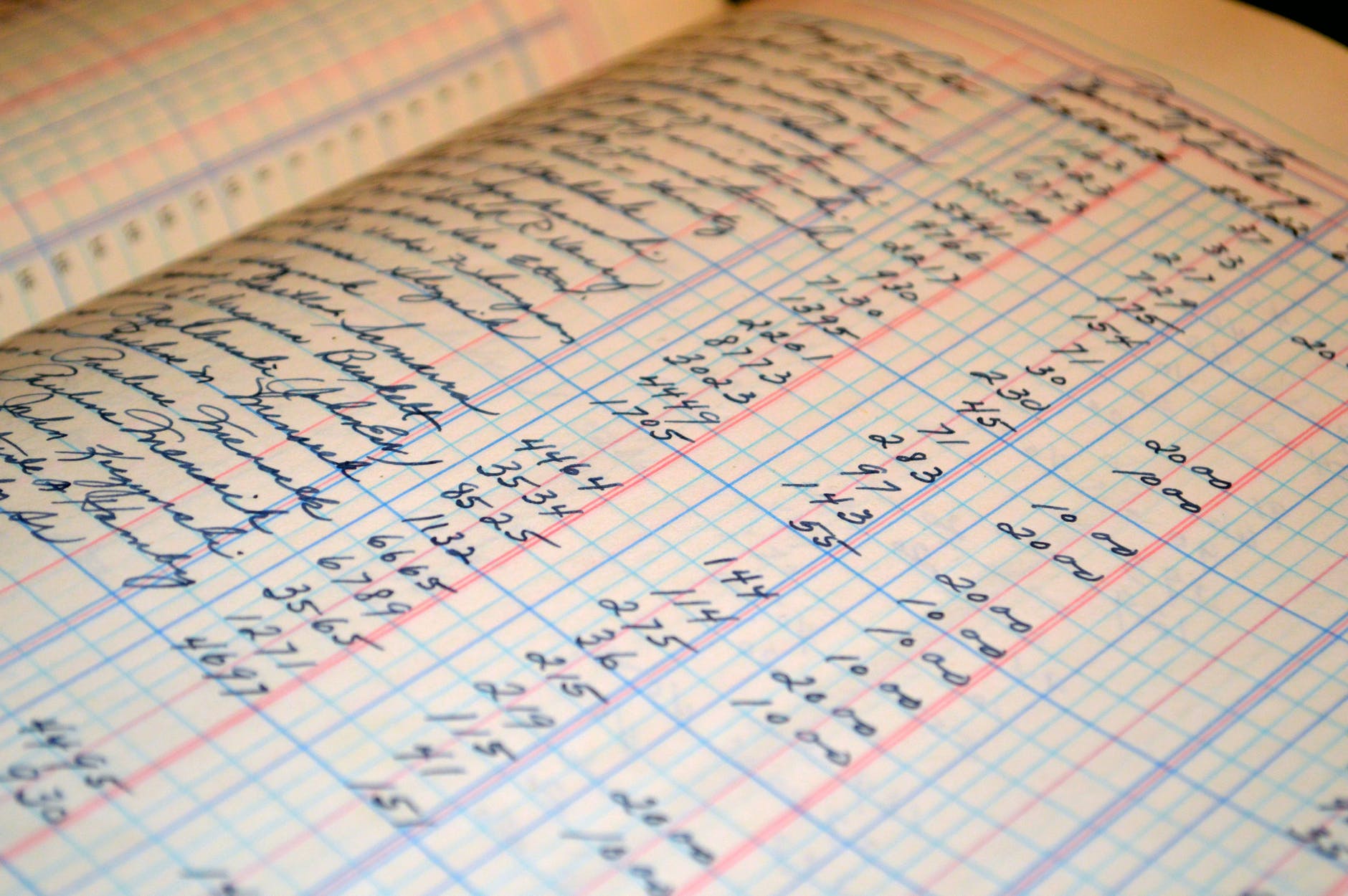

Trade debtors, also known as accounts receivable, are amounts owed to a company by its customers or clients for goods sold or services rendered on credit.

When a company provides products or services to a customer without receiving immediate payment, it creates an account receivable or trade debtor (an asset to the business, shown in the balance sheet).

Trade debtors make up a vital part of working capital and can have a significant impact on its cash flow and financial health. Accordingly monitoring their collection is critical.

Trade Debtor Days measurement is used by most businesses that extend credit. Trade Debtor Days measure the average number of days it takes for a company to collect payment from its customers / clients.

It is calculated as follows:

(Average Trade Debtors / Sales on Credit) * Number of Days

If you wanted to calculate the average amount of days that it took for your business to collect its receivable last financial year, then:

Accounts Receivable at 30 June 2022 $350,000

Account Receivable at 30 June 2023 $425,000

Total Sales on credit $4,000,000

(350,000 + $425,000) / 2 / 4,000,000 * 365 = 35 days.

Generally, the smaller the number of days the better.

If you would like to discuss further, please contact us:

McNamara & Company - Chartered Accountants, located minutes from the Melbourne CBD

www.mcnamaraandco.au/contact-us

Phone +61 3 9428 1062

Email admin@mcnamaraandco.au

Please refer to disclaimer at the bottom of the page.